Nobody likes to receive their tax statement. But did you know that motorcyclists who commute between home and work and/or business trips (visiting customers, taking part in seminars, etc.) by motorbike or scooter can claim significantly more justifiable business expenses (100%) than motorists? People who use their cars are subject to other rules.

This article aims to help you as a private individual to assess the tax impact of your mobility. Going to work on a motorcycle not only gives you more mobility (faster journeys by avoiding traffic jams, easier parking), but also allows you to recover much greater costs through taxes.

A. Flat-rate or actual costs?

The general package

- The flat rate, also known as the "legal rate", covers all business expenses, including those for using your vehicle for your home-work travel. This also covers the public transport season ticket for travel to your workplace, the planning of space in your home that you use for your business or the purchase of equipment and literature that you finance yourself.

- For salaried employees (Framework IV), the legal lump sum depends on salary and amounts to a maximum of €4,880 for the 2020 tax year, to be calculated as follows: 30% on a maximum amount of €16,266.64

Personal travel from home to your workplace

- Flat-rate kilometre allowance: A flat rate of €0.15/km driven applies. However, the distance between home and your workplace may not exceed 100 km (single journey).

- Actual costs: Whatever your profession, you can always choose to deduct your actual business expenses. However, you must prove that these costs are genuine and provide proof that you have paid them yourself. You must be able to present any supporting documents (maintenance book, maintenance invoices, fuel purchase, transport ticket, public transport subscription, etc.)

- The easiest way is to generate a simulation via tax-on-web. The online tool will calculate what the total amount of the surcharge or tax refund would be by applying the flat-rate system and what this amount would be if the actual costs were declared. But rest assured, if you opt for the actual costs and they are ultimately lower than the fixed amount, the tax authorities will still automatically apply the fixed amount.

- Please note:

- If you already receive compensation from your employer for your business travel, it must of course be deducted from your costs.

- If you do not prove their business expenses, you will automatically be granted the exemption of a maximum of €410 (for the 2021 tax year) for travel between home and the workplace. If you choose to include the actual costs, you will not be able to use this code and must enter 0.

Business travel:

By the same principle, you can opt for the kilometre flat rate or the actual costs.

B. Only claim back the share of business travel and between home and work

It would be difficult for the tax authorities to allow the motorcycle to be used only for business travel and between home and the workplace. Driving on two wheels is in fact far too enjoyable not to take advantage of it during weekends and holidays. Your expenses must therefore be included proportionally according to the ratio between the actual number of kilometres travelled for business travel and workplace travel and private travel. The following calculation forms the basis for the proportional final valuation of all the fees (discussed below) that you must bear.

Example of the calculation of the share of commuting (combination of moped and motor vehicle):

1) Number of days worked: 231 days (this number is officially included on your payslip)

a. of which by motorcycle: 215 days

b. of which by car: 16 days

2) Number of kilometres between home and your workplace (outward and return journey): 60km

3) Total number of kilometres driven in 2020 by motorcycle (tip: take a photo of the kilometre reading around these dates):

a. Kilometre reading as of 01/01/2020: 18,341

b. Kilometre reading as of 21/12/2020: 33,947

c. Kilometres travelled: 15,606

d. Share of business travel: 215 days x 60km = 12,900km, i.e. 82.66% of the total number of kilometres

You do not necessarily need to consider the shortest distance between your home and your workplace. If you can demonstrate that another longer route is safer, you can apply this longer distance.

It is important to be able to prove that you are going to work on a motorcycle and that the kilometre readings of your vehicle correspond to your statements:

- Ask your employer to provide you with a certificate that you travel to work on a motorcycle (all or part of the year).

- Prove on the basis of maintenance invoices (with the kilometre reading from the odometer!) that you use your bike frequently.

- Take regular photos of your odometer with a date stamp.

- Keep the receipts for all your visits to the fuel station and refuel near your place of work regularly.

C. Motorcycle or scooter: decreasing and/or linear depreciation

The depreciable value is equal to the purchase price including VAT. For motorcycles, the period over which the depreciation can be spread mainly depends on the lifespan of the motorcycle (which depends on the make, model) and the intensity of use or number of kilometres driven. In general, a 5-year period can be considered reasonable for the depreciation of a new motorcycle used normally; 3 years for a second-hand vehicle.

You must of course have an invoice. However, a sale from one private individual to another is also valid for a second-hand motorcycle if it can be justified by a written declaration between the parties concerned.

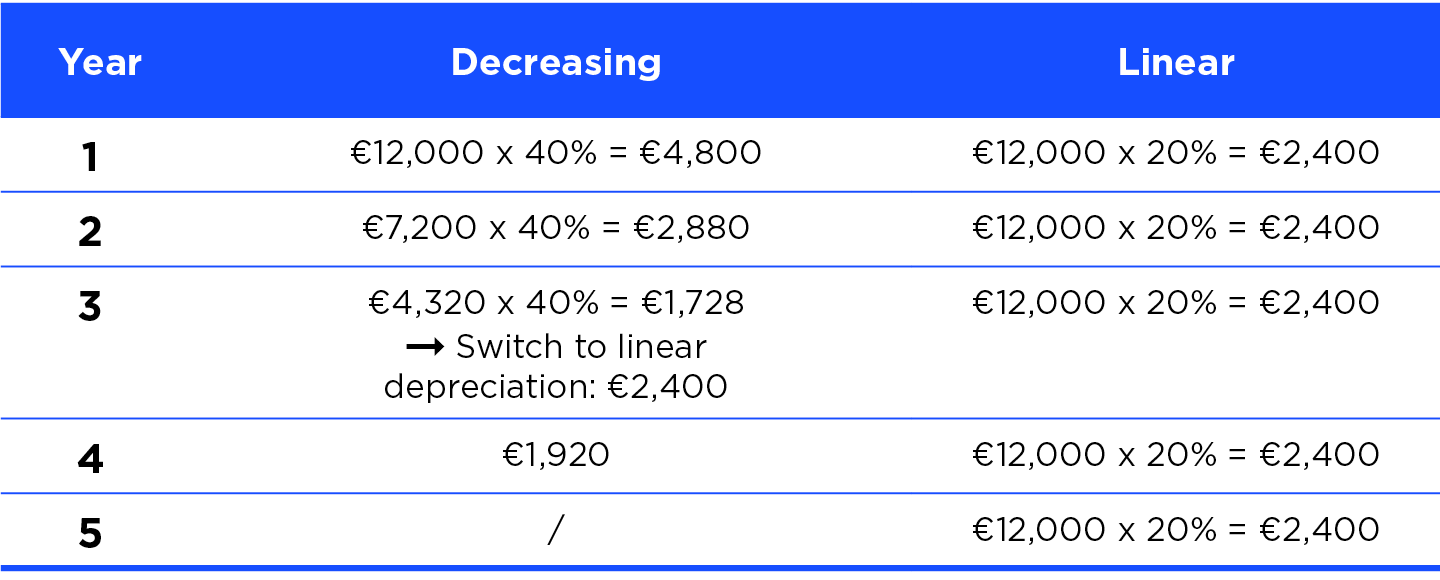

The choice of decreasing or linear depreciation is open. The decreasing method makes it possible to quickly deduct a large amount (while remaining limited to 40%) as a business expense in the year of purchase. If, after a few years, the depreciation is less than the straight-line depreciation, it is still possible to switch to straight-line depreciation.

Example calculation for a moped with a new value of €12,000 (incl. VAT):

In the example above, it is more beneficial (but not essential) to switch from decreasing to linear depreciation from the third year. If you buy additional accessories, you can add them to the value of the bike and include them in the depreciation (also to be proved on the basis of an invoice).

Please note: if you opt for decreasing depreciation, you will need to notify the authorities specifically when you file your first tax return following the purchase, by attaching the '328K' form to your return. If you do not, your declaration may be rejected.

Please note: you can no longer enter any depreciation in the year the bike is sold.

D. Protective clothing

The tax authorities accept that "protective motorcycle equipment" is a deduction item as a business expense. Generally, it accepts a payback period of 3 years and straight-line depreciation is the best method for this.

This includes:

- helmet (but also care products)

- motorcycle jacket and trousers (but also care products)

- motorcycle gloves

- additional means of protection worn under the jacket

- shoes or boots (which protect the ankles)

- thermal underwear

- reflective tracksuits

- rain protection equipment

- ear plugs

- scarf, neckerchief

Please note that this equipment is only eligible if:

- this is specific protective equipment

- It was bought from a specialist motorcycle shop

- you can prove your purchase by an invoice specifying the make or model and giving a description of the equipment purchased

Not included: T-shirts, jumpers, socks etc.

Please note that these costs can only be deducted proportionally depending on the ratio between business travel and commuting and the total annual mileage. See point B.

E. Fuel

It is important to keep the receipts for all your pump visits. We also advise you to refuel regularly near your place of work. This can be accepted as proof that you are actually going to work on a motorcycle. You can find the official average fuel price for the year in question on the FPS Economy website.

F. Other expenses

You can certainly declare many more costs than simply depreciating the purchase price of your bike (or the interest on financing costs). The following are also eligible:

- registration tax (keep your proof of payment carefully)

- annual road tax (keep your proof of payment carefully)

- maintenance and repairs (keep your invoices carefully)

- insurance

- breakdown assistance agreement

This list is in principle not exhaustive, but we recommend that you do not want to test the limits of the system by any means. All of the above additional costs are reasonable. However, sometimes you can go one step too far. Safety is important, so you can take an advanced motorcycle riding training course; you may be able to argue that these costs are equally relevant, but we do not recommend this. However, you could deduct some of the use of your smartphone (to be reachable on the way or to use the navigation system), but again depending on the percentage of business use compared to private use.

G. In specific terms

The easiest way is to make a statement in Excel of all your expenses (which you can then re-use each year, subject to the necessary adjustments). All you have to do is attach this statement to your tax return. It is not mandatory to attach supporting documents (invoices, receipts at the pump, transfers), but you must keep them.

H. Deadline

The paper declaration must be filed by the end of June. If you fill it in via tax-on-web, you have until mid-July. A deferral (for example, if you have not yet been able to gather all the supporting documents, but only if you can provide proof of force majeure) is possible by means of a request, stating the reasons, sent before the deadline for filing the declaration.

Please note

This article has been written based on the information on the FPS FINANCESwebsite. It is important to emphasise that the tax rules change each year and that the information contained in this article may no longer be up to date. Additional advice from a tax advisor who is familiar with tax deductions for motorcycle use is therefore always recommended.